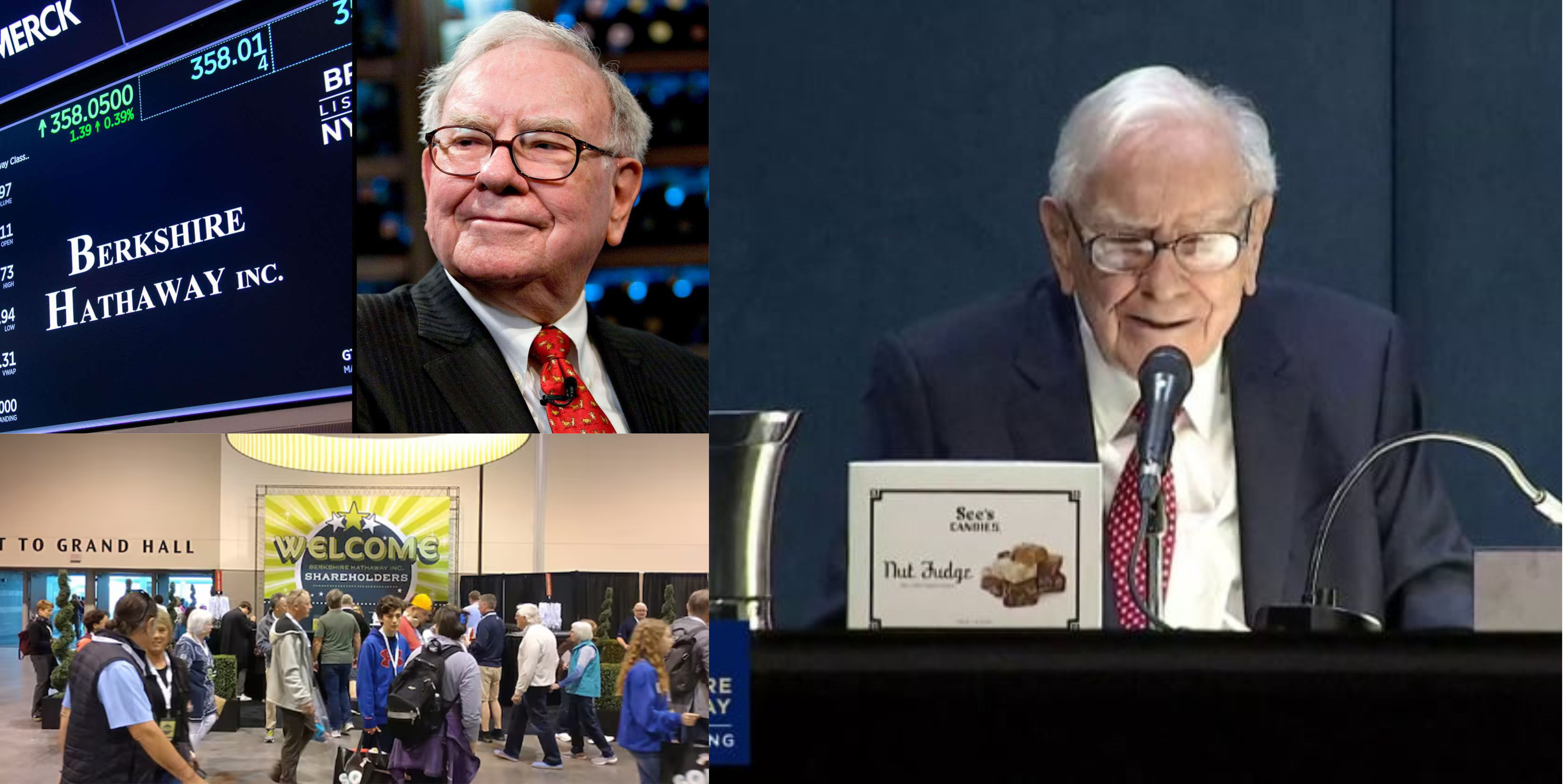

Warren Buffett revealed that Berkshire Hathaway pocketed $100 million daily, even on weekends, throughout 2023. He shared this impressive feat during the discussion of the company’s quarterly earnings at the Annual Shareholder Meeting on May 4th.

In its first quarterly report, Berkshire Hathaway disclosed operating earnings of $11.2 billion, marking a notable increase from $8.07 billion in the previous year. The company also revealed a record-high cash reserve of $188.99 billion, up from $167.6 billion in the fourth quarter. Buffett emphasized the firm’s readiness to seize opportunities for deploying this capital as they arise.

On May 3, ahead of the earnings report, Berkshire Hathaway Class A stock closed marginally down by 0.56 percent at $603,000. However, its shares have shown resilience throughout the year, posting an approximately 11 percent gain, surpassing the Dow Jones index’s 2.55 percent return.

Buffett projected a moderate rise in Berkshire’s earnings, underscoring the company’s commitment to bolstering operating earnings while reducing outstanding shares. In the first quarter alone, Berkshire Hathaway allocated $2.6 billion to buy back its shares, following a $9.2 billion repurchase in 2023.

By the close of March 2024, the company’s shareholder equity surged to $571.49 billion. Buffett humorously recalled that apart from a dividend announcement of 10 cents per share in 1967, Berkshire Hathaway had consistently retained earnings under his stewardship. He jokingly remarked that he missed the decision-making moment, being occupied in the restroom at the time. Reflecting on the company’s financial prudence, Buffett noted, “If you leave out that period of madness, we’ve been consistently saving and investing your money. While some decisions were missteps, none approached catastrophic errors.”